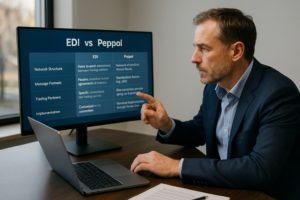

Peppol vs EDI: Which e-invoicing solution suits your company?

Companies looking to transition to electronic invoicing often encounter two major players: Peppol and EDI. Both have their own characteristics and applications. To make an informed choice, it’s important to understand exactly what they entail and how they relate to each other.

EDI: Electronic Data Interchange

EDI stands for Electronic Data Interchange. It’s a collective term for various standards and methods used to exchange business data electronically. EDI has been used for decades in sectors such as retail, logistics, and manufacturing.

EDI connections are established between specific trading partners. Companies make mutual agreements about the format and content of messages. These customized arrangements ensure that systems know exactly what to expect.

In sectors where EDI is strongly established, sector-specific standards have often been developed. Think of EDIFACT in logistics or GS1 in retail. These standards are specifically tailored to the needs of those sectors.

Peppol

Peppol is an international network that uses standardized formats and protocols. Companies connected to Peppol can communicate with all other connected parties without having to make prior mutual arrangements.

The network utilizes certified Access Points. These ensure the security and reliability of message traffic. Each company chooses its own Access Point provider and can thereby reach the entire network.

Comparing Characteristics

To clarify the differences between both systems, we list the key features:

| Feature | EDI | Peppol |

|---|---|---|

| Network structure | Point-to-point connections between trading partners | Network of certified Access Points |

| Message formats | Flexible, based on mutual agreements or sector standards | Standardized formats (such as UBL) |

| Trading partners | Specific connections per trading partner | One connection provides access to all connected parties |

| Implementation | Customization per connection | Standard implementation via Access Point |

| Usage | Strongly embedded in specific sectors (retail, logistics, manufacturing) | Widely used for e-invoicing, especially in the government sector |

| Management | Maintenance required per connection | Centrally managed via Access Point |

EDI and Peppol differ in their approach to electronic data exchange. EDI emphasizes customized agreements between trading partners. This provides great flexibility in determining message formats and processes. However, it requires specific implementations for each new trading partner.

Peppol opts for standardization. All participants use the same formats and protocols. This makes it easier to connect new trading partners but offers less room for customization in message formats.

Practical Applications

In sectors where EDI has a strong presence, we often see hybrid situations emerging. Companies continue to use EDI for existing trade relationships and specific sector processes. For new relationships or government contracts, they choose Peppol.

For example, a retailer might continue to use EDI for communication with established suppliers, where years of process optimization are involved. For new suppliers or government customers, they then use Peppol.

Regulatory Developments

New legislation plays a role in the choice between EDI and Peppol. In Belgium, for instance, e-invoicing via Peppol will become mandatory for Business-to-Government invoicing from 2025, followed by Business-to-Business in 2026. Such developments influence the choices companies make.

Conclusion

The choice between EDI and Peppol depends on various factors:

- The sector in which you operate

- Whether you have many established trade relationships

- The need for customization in message formats

- Future legislation in your market

- The preferences of your trading partners

For many companies, it’s not a matter of choosing one or the other. They use both systems, each for its own purpose. EDI for specific sector processes and existing relationships, Peppol for new relationships and government contracts.

Therefore, carefully examine your own situation. Which systems do your key trading partners use? What regulations are relevant to your sector? And how do you expect this to develop in the coming years? Based on these considerations, you can make an informed choice that suits your company.