Spain starts e-invoicing January 2026 – parallel with Belgium, but with a crucial difference

In September 2022, the Spanish government announced the “Crea y Crece” law (Law 18/2022) – an ambitious plan for mandatory electronic invoicing between businesses. At the time, this seemed like a distant future. But on December 6, 2023, it suddenly became concrete: the Spanish government published Royal Decree 1007/2023 in the official state gazette (BOE), with an implementation date that surprises many Dutch entrepreneurs: January 1, 2026 – exactly the same date Belgium introduces its e-invoicing mandate.

While many companies are already preparing for the Belgian mandate, the Spanish development often stays under the radar. This is risky, because for Dutch entrepreneurs doing business with Spanish partners – from horticultural exporters to Barcelona to IT suppliers with customers in Madrid, from logistics companies regularly driving to Valencia to consultants advising Spanish companies – there’s a double challenge: not only might you need to comply with two national mandates, but the Spanish system also works fundamentally differently.

Because here’s the crucial difference: where Belgium chooses one clear Peppol-based system, Spain introduces two different systems operating side by side. Royal Decree 1007/2023 introduces VeriFactu (requirements for invoicing software) starting in just two months, while the “Crea y Crece” law lays the foundation for a later B2B e-invoicing mandate (2027/2028). This dual approach, combined with the short timeline and parallel implementation with Belgium, creates urgency and confusion – especially for international trading partners who must now understand what’s expected of them for both countries simultaneously.

Let’s make it clear.

The Spanish dual track: VeriFactu AND B2B e-invoicing

Where most European countries choose one e-invoicing system, Spain introduces two parallel obligations:

Track 1: VeriFactu (from January 1, 2026) An obligation to use certified invoicing software that guarantees the integrity and immutability of invoices. This is not a system for exchanging invoices between businesses, but a requirement for the software you use to create invoices.

Track 2: B2B e-invoicing mandate (from 2027/2028) A future obligation for electronic exchange of invoices between businesses, similar to the systems in Belgium and France. This requires structured formats and possibly a central platform managed by the Spanish tax authority (AEAT).

The crucial distinction:

- VeriFactu = requirements for your invoicing SYSTEM (software certification)

- B2B mandate = requirements for invoice EXCHANGE (electronic transmission)

For Dutch companies supplying to Spanish customers, this raises fundamental questions: do we fall under these obligations? And if so, which ones? Or both?

VeriFactu: What is it and who must use it?

VeriFactu (officially: Royal Decree 1007/2023) sets strict requirements for invoicing software and electronic invoicing systems. The core idea is fraud prevention: by requiring all invoicing software to record data immutably and traceably, manipulating invoices becomes much harder.

The core requirements of VeriFactu:

1. Standardized invoice registration Every invoicing system must create an immutable registration for each invoice that guarantees integrity and traceability.

2. QR code on every invoice All invoices must contain a QR code with identifying data, allowing customers and tax authorities to verify authenticity.

3. Software conformity declaration Software suppliers must confirm that their applications comply with the technical and functional requirements.

4. Two implementation options:

Option A: Real-time reporting (VeriFactu with submission) The invoicing software automatically sends all invoice data to the Spanish tax authority (AEAT) in real-time. This happens simultaneously with or before issuing the invoice.

Option B: Local storage (VeriFactu without submission) The invoicing software stores all invoice data locally according to strict audit requirements, without real-time transmission to AEAT. During an audit, all data must be immediately available.

VeriFactu implementation dates:

January 1, 2026: Mandatory for all companies subject to Corporate Income Tax

July 1, 2026: Mandatory for self-employed individuals and freelancers (autónomos)

Important exception: Companies already participating in the SII system (Immediate Supply of Information – mandatory for large companies since 2017) do NOT need to implement VeriFactu. They already report to AEAT in real-time via another system.

The future B2B e-invoicing mandate: What’s coming?

Besides VeriFactu, Spain is preparing a fully mandatory B2B e-invoicing system, established in the “Crea y Crece” law (Law 18/2022). This system concerns the exchange of electronic invoices between businesses.

What will this system mean?

Structured formats mandatory: Invoices must comply with the European EN 16931 standard. Permitted formats:

- Facturae (XML) – Spanish national format

- UBL (Universal Business Language)

- UN/CEFACT CII (Cross Industry Invoice)

Central AEAT platform: The Spanish tax authority is developing a public platform for e-invoicing, alongside private platforms from service providers. This resembles the French PPF model.

Invoice Response obligation: Invoice recipients must report the status to AEAT within 4 calendar days:

- Acceptance or rejection of the invoice

- Full or partial payment

- Other status updates

This creates transparency and helps reduce late payments.

Phased implementation of B2B mandate:

2027 (likely): Large companies with revenue > €8 million must fully use electronic invoicing

- Starts 12 months after publication of final regulations in the state gazette

- These regulations haven’t been published yet but are expected in 2025/2026

2028 (likely): All other companies must use electronic invoicing

- Starts 24 months after publication of final regulations

Note: These dates are not final yet. The final regulations still need to be published, and the deadline may still shift. Follow AEAT’s official announcements closely.

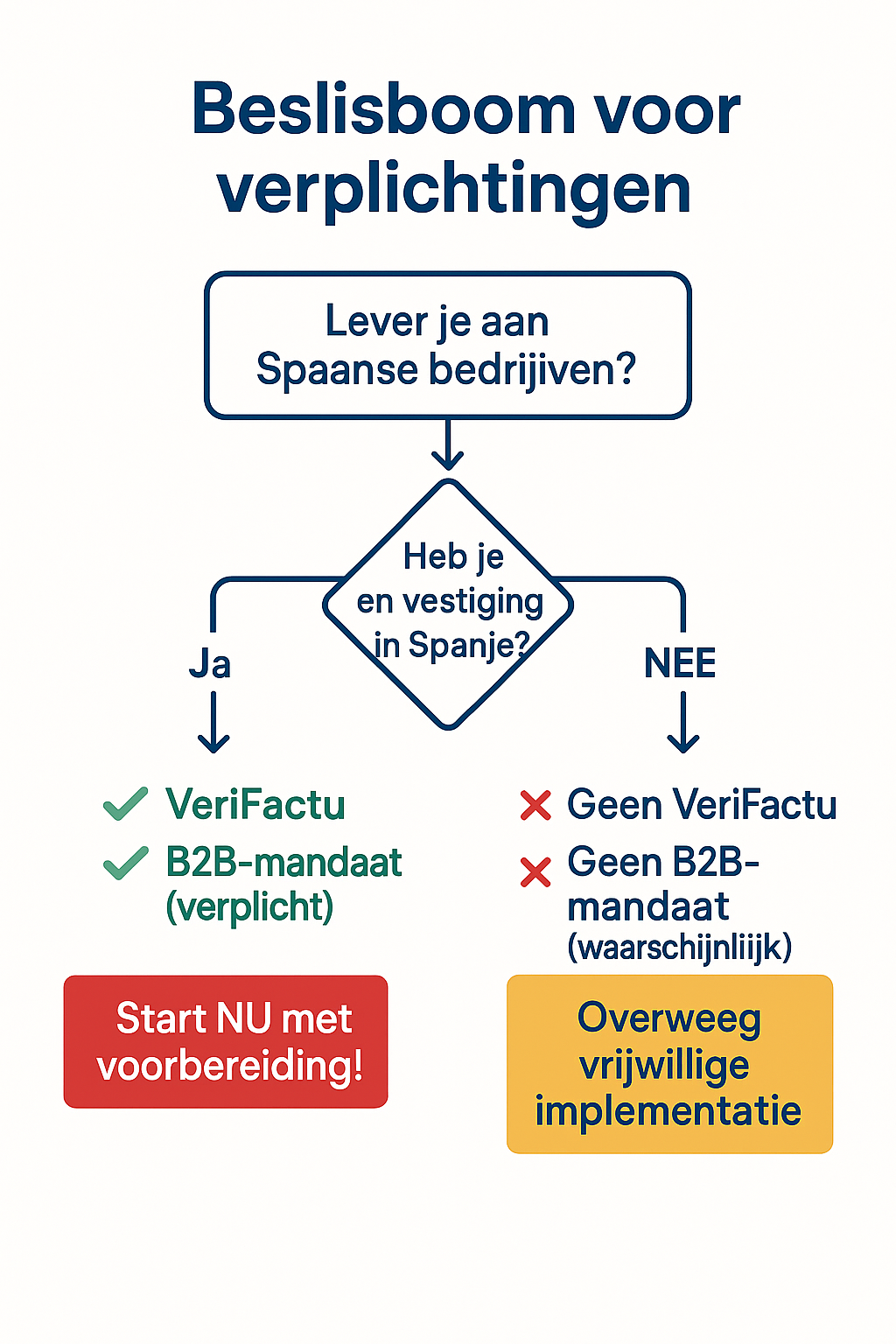

Scenarios for international trading partners

Now that the systems are clear, the crucial question: what does this mean for Dutch companies doing business with Spain?

Scenario 1: Dutch exporter without establishment in Spain

GreenTech Solutions BV from Westland supplies advanced greenhouse systems to Spanish growers. The company has no office or staff in Spain, but does have a Spanish VAT number (NIF) for these deliveries.

The reality for VeriFactu:

VeriFactu targets “resident taxpayers” – taxpayers established in Spain. The regulations speak of “taxpayers subject to Corporate Income Tax” and “those subject to Income Tax” – both categories refer to Spanish fiscal residents.

For GreenTech this likely means: no VeriFactu obligation. As a foreign company without permanent establishment, it falls outside the scope.

The reality for future B2B mandate:

Here it gets more interesting. The “Crea y Crece” law speaks of mandatory e-invoicing for “all businesses” without explicit distinction between resident and non-resident. However, comparable systems in other countries (Belgium, France) typically only require companies WITH an establishment in the country.

Likely scenario: No full obligation for GreenTech, unless they have a permanent establishment.

But – and this is crucial: GreenTech’s Spanish customers (like growers in Almería) will from 2027/2028 be required to receive electronic invoices from their Spanish suppliers. This means they must maintain two parallel invoice processing channels:

- E-invoices from Spanish suppliers

- Traditional invoices from international suppliers like GreenTech

Scenario 2: German manufacturing company with Spanish establishment

Automotive Components GmbH from Stuttgart has an assembly hall in Burgos with 85 employees, own warehouses and production equipment. From this Spanish establishment they supply parts to Spanish car manufacturers.

The reality:

A foreign company with a permanent establishment in Spain is considered a “resident taxpayer” for VAT purposes and falls fully under all Spanish e-invoicing obligations.

Automotive Components must:

- Implement VeriFactu (January 1, 2026):

- Use certified invoicing software

- Include QR codes on all invoices

- Choose between real-time reporting to AEAT or local storage with audit compliance

- Comply with B2B e-invoicing mandate (2027):

- Exchange electronic invoices according to EN 16931 standard

- Send Invoice Response messages within 4 days

- Possibly integrate with AEAT platform

The criterion is clear: Not the nationality of the parent company determines the obligation, but the presence of a permanent establishment on Spanish territory conducting commercial activities.

Scenario 3: Belgian consultancy without permanent establishment

Advisory Partners BVBA from Antwerp provides strategic advice to Spanish companies in the logistics sector. Consultants fly in for projects, work from hotels or client locations, but the company has no office or staff in Spain. They do have a Spanish VAT number for certain services.

The reality:

No permanent establishment likely means no VeriFactu obligation and likely no B2B e-invoicing obligation (once it becomes active).

Advisory Partners can continue invoicing as they always have: PDF via email, paper invoice, or whatever format their client prefers.

The consequence for their Spanish clients:

From 2027/2028, Advisory Partners’ Spanish clients must handle two different invoice processing systems:

- Electronic invoices from Spanish suppliers

- Traditional invoices from international advisors like Advisory Partners

This creates extra administrative burden for the Spanish companies.

The strategic opportunity:

By voluntarily switching to electronic invoicing (even though not required), Advisory Partners can distinguish themselves from competitors and improve their Spanish clients’ administrative efficiency. This can become a concrete sales argument.

The dual administration problem for Spanish companies

Spanish businesses are confronted with a complex challenge coming in two phases:

Phase 1 (from January 2026): VeriFactu compliance

All Spanish companies must upgrade their invoicing software to VeriFactu-certified systems. This means:

- Investment in new software or upgrading existing systems

- Staff training

- Implementation of QR code generation

- Choice between real-time reporting or local storage

Phase 2 (from 2027/2028): Dual invoice processing

Once the B2B e-invoicing mandate becomes active, the dual administration problem arises:

Channel 1: Electronic invoices via structured formats and possibly AEAT platform for all Spanish suppliers

Channel 2: Traditional invoices (PDF, paper, email) for international suppliers without establishment

The consequences:

- Two different workflows for accounts payable

- Dual systems and increased operational costs

- Increased risk of processing errors

- More complex reconciliation with VAT returns

- Longer lead times for invoice approval

When exactly do the obligations apply?

VeriFactu (certain):

Mandatory for:

- All taxpayers established in Spain who use electronic invoicing systems

- Companies subject to corporate income tax (from January 1, 2026)

- Self-employed individuals and freelancers (from July 1, 2026)

- Foreign companies with a permanent establishment in Spain

Exempt:

- Companies already participating in SII (Immediate Supply of Information system)

- Companies exempt from invoicing obligations

- Non-resident companies without permanent establishment (likely)

B2B e-invoicing mandate (expected):

Mandatory for:

- All companies established in Spain for domestic B2B transactions

- Large companies (>€8M revenue) from 2027

- All other companies from 2028

- Foreign companies with a permanent establishment in Spain

Likely exempt:

- Non-resident companies without permanent establishment

- B2C transactions (different rules)

- Certain exempt transactions

Note: The final regulations for the B2B mandate have yet to be published. Dates and exact scope may still change.

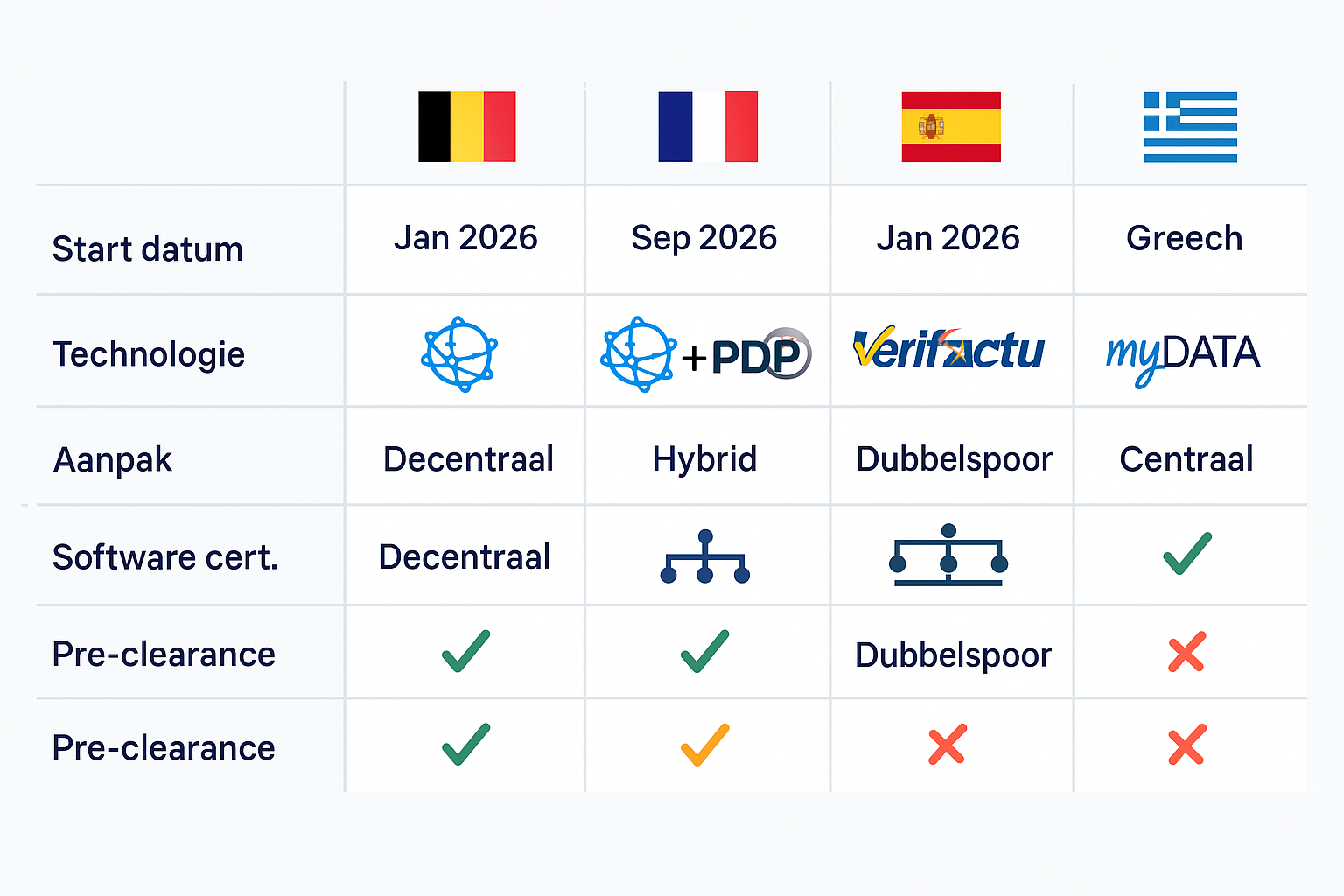

Spain vs. other European countries: The comparison

It’s useful to compare the Spanish approach with other European e-invoicing mandates:

Spain vs. Belgium (January 2026)

Belgium: Chooses a fully decentralized Peppol 4-corner model. All companies choose their own Peppol Access Point, no central government platform.

Spain: Hybrid model with certified software (VeriFactu) and likely a central AEAT platform for B2B exchange (like France).

Similarity: Both countries start in 2026, both target all companies (no revenue thresholds).

Difference: Belgium focuses on exchange via Peppol network, Spain starts with software certification.

Spain vs. France (September 2026)

France: DGFiP has officially become a Peppol Authority (July 2025). Companies must work through certified Partner Dematerialization Platforms (PDPs), including Peppol.

Spain: Developing own AEAT platform alongside private service providers. No clear Peppol adoption announced yet.

Similarity: Both countries require certified platforms/software and have a public platform alongside private options.

Difference: France explicitly chooses Peppol interoperability, Spain’s direction is less clear.

Spain vs. Greece (February 2026)

Greece: Central clearance model via myDATA platform. All invoices must be validated by the tax authority before going to the customer.

Spain: VeriFactu offers choice between real-time reporting and local storage. The future B2B mandate will likely have a clearance element, but details are still unclear.

Similarity: Both countries want strong government control and fraud prevention.

Difference: Greece already has full mandatory clearance, Spain is building gradually.

The European context

All national mandates anticipate the EU-wide ViDA regulation (VAT in the Digital Age), which introduces mandatory e-invoicing for intra-community transactions from 2030. Companies investing in Spanish compliance now are simultaneously preparing for these future EU requirements.

The SII system: The third player

To completely understand the Spanish situation, we must also mention the existing SII system (Suministro Inmediato de Información) that has existed since 2017.

What is SII?

SII requires large companies (and companies filing monthly VAT returns) to send their sales and purchase ledgers to AEAT within 4 days. This replaces traditional quarterly reporting with near real-time reporting.

Who must use SII?

Mandatory for:

- Large companies (revenue > €6 million)

- Companies in a group with a large company

- Companies filing monthly VAT returns

- Companies registered in the Monthly Refund Register (REDEME)

Voluntary for: All other Spanish companies can opt for SII

SII and VeriFactu: How do they relate?

Crucial rule: Companies already using SII do NOT need to implement VeriFactu. They already report to AEAT in real-time via the SII system.

But: If an SII company issues invoices on behalf of a third party (self-billing), that specific process must be VeriFactu-compliant.

The three systems side by side:

For large Spanish companies, this creates the following picture:

- SII – Real-time reporting of sales and purchase ledgers (exists since 2017)

- VeriFactu – For companies NOT on SII (from 2026)

- B2B e-invoicing mandate – For electronic exchange (from 2027/2028, applies to everyone)

This explains why the Spanish situation is so complex: there are literally three different systems operating in parallel for different target groups.

Practical advice for all stakeholders

For Dutch companies without Spanish establishment:

1. Monitor the situation closely

The regulations for the B2B mandate are not final yet. Keep an eye on official announcements from AEAT for clarification about obligations for non-resident suppliers.

2. Communicate proactively with Spanish customers

Start conversations now about how your invoicing process will evolve. Even if you’re not required to use e-invoicing, consider implementing it voluntarily to help your Spanish customers.

Example communication:

“We understand that Spain is introducing mandatory e-invoicing from 2026/2027. Although we as an international company may not fall under all obligations, we would like to discuss with you how we can optimize our cooperation. Would electronic invoices in a structured format facilitate your administration? We are open to facilitating this if it helps you.”

3. Consider Peppol connectivity

If Spain ultimately embraces Peppol (like Belgium and France), Dutch companies with existing Peppol infrastructure can connect seamlessly. One investment in Peppol then works for multiple markets.

4. Ask for clarity about invoice formats

Check with your Spanish clients which formats they’ll need from 2027/2028. Facturae (XML)? UBL? CII? This helps you prepare.

For Dutch companies WITH Spanish establishment:

Immediate actions (now through December 2025):

1. VeriFactu compliance becomes top priority

With a deadline of January 1, 2026 (less than 3 months away!) you must take action now:

- Assess your current invoicing software: Does it already meet VeriFactu requirements? If not, is an update available?

- Contact your software supplier: Ask specifically about VeriFactu certification and implementation timelines

- Consider alternatives: If your current software won’t become compliant, you must switch to a certified system now

2. Choose your VeriFactu strategy

Decide whether you choose:

- Real-time reporting (invoice data directly to AEAT) – safest, least risk during audit

- Local storage (save according to strict audit requirements) – more control, but higher requirements during inspection

3. Train your staff

All employees creating invoices must:

- Understand how the new system works

- Know how QR codes are generated

- Know the new workflows

4. Test thoroughly

AEAT has a test environment available. Use this to test your system before the obligation takes effect.

Preparation for B2B mandate (2025-2026):

1. Follow regulatory developments

The final regulations for the B2B mandate are expected in 2025 or early 2026. Monitor publications from AEAT and the State Gazette (BOE).

2. Anticipate structured formats

Start looking at which systems can invoice EN 16931-compliant (UBL, CII, Facturae).

3. Prepare your accounts payable process

The Invoice Response system (reporting within 4 days) may require adjustments to your accounts payable workflows.

For Spanish companies (tips for Dutch partners):

If your Dutch partner asks: “What does your company need from us for e-invoicing?”, help them with this information:

For receiving invoices:

“From 2027/2028 we must be able to receive electronic invoices in a structured format like UBL or Facturae (XML). If you can deliver this – even though you’re not required to – it would greatly help our administration. We would appreciate having your Peppol ID if you have one, or else we can look together at other electronic exchange methods.”

For understanding your situation:

“We understand that as an international company you may not be required to use VeriFactu or the B2B mandate. But if you’re willing to move voluntarily with our digitization, we greatly appreciate that. It prevents us from having to maintain two different invoice processing systems.”

For software suppliers and ERP providers:

VeriFactu certification is urgent

If you offer software to companies with Spanish establishments, VeriFactu compliance must be available now. The deadline is January 1, 2026.

Core requirements for VeriFactu:

- Immutable invoice registration

- QR code generation with correct data

- Ability to issue conformity declaration

- Offer choice between real-time reporting and local storage

- Integration with AEAT test environment

Preparation for B2B mandate:

Ensure your software:

- Can invoice EN 16931 compliant (UBL, CII, Facturae)

- Can generate Invoice Response messages

- Has API connectivity for integration with future AEAT platform

- Offers multi-country support (Spain + Belgium + France + more)

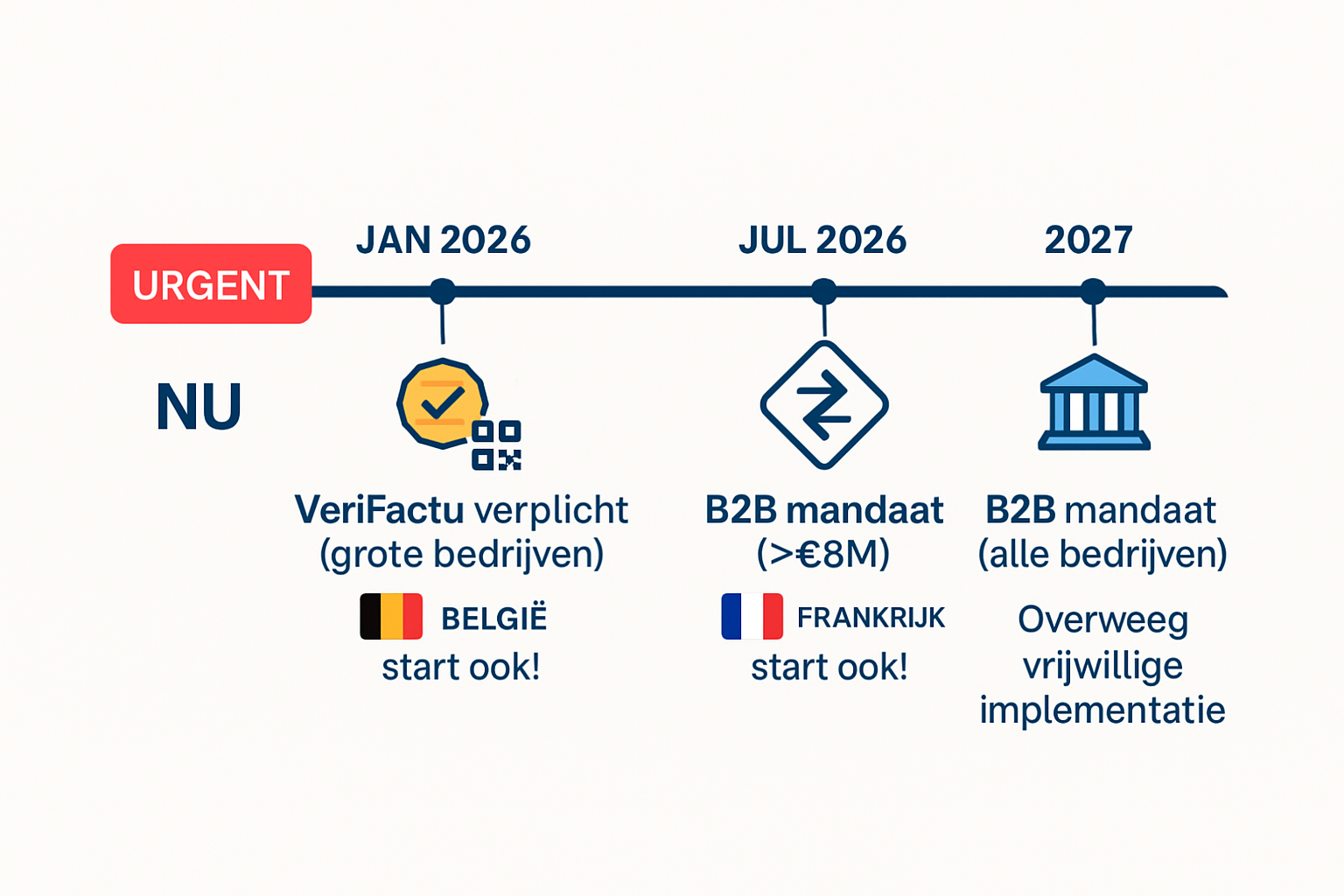

Timeline and critical moments

Now – December 31, 2025:

- Urgent action required for companies with Spanish establishment

- Implementation of VeriFactu-certified software

- Testing in AEAT environment

- Staff training

January 1, 2026:

- VeriFactu mandatory for all companies subject to corporate income tax

- Penalties for non-compliance: up to €50,000 per fiscal year

July 1, 2026:

- VeriFactu mandatory for self-employed individuals and freelancers

2025/2026 (expected):

- Publication of final B2B e-invoicing mandate regulations in State Gazette (BOE)

- Start of the 12-24 month countdown for implementation

2027 (likely):

- B2B e-invoicing mandate active for large companies (>€8M revenue)

- 12 months after publication of regulations

2028 (likely):

- B2B e-invoicing mandate active for all other companies

- 24 months after publication of regulations

Sanctions and enforcement

Spain takes compliance seriously and applies significant fines:

VeriFactu sanctions:

For software users:

- Non-use of certified software: up to €50,000 per fiscal year

- Manipulation of invoice data: up to €50,000 per year

For software suppliers:

- Offering non-compliant software: up to €150,000 per year

- Incorrect conformity declarations: up to €150,000 per year

B2B e-invoicing sanctions (expected):

Invoice errors:

- 1-2% of transaction value

- Up to 75% for deliberate fraud

Invoice Response non-compliance:

- Fines for not reporting within 4 days

- Increased fines for repeated violations

SII late reporting:

- Administrative fines according to existing regime

The big question: Is Peppol coming to Spain?

A question we regularly hear: “If Belgium and France use Peppol, why not Spain?”

The honest answer: it’s still unclear.

Arguments for Peppol in Spain:

- EU-wide harmonization: ViDA regulations from 2030 stimulate Peppol adoption

- International trade: Spanish companies trade extensively with Belgium, France, Netherlands – all Peppol countries

- Existing B2G infrastructure: Spain already uses Facturae (XML) for B2G, which is technically related to Peppol formats

- Interoperability: Peppol prevents vendor lock-in and stimulates competition

Arguments against (or at least: delay):

- Existing systems: SII has been operational since 2017 and works well

- Control: AEAT seems to prefer central control (clearance model)

- VeriFactu focus: Priority now lies with software certification, not network interoperability

- Own platforms: AEAT is developing its own solutions

What does this mean for your strategy?

Be prepared for both scenarios:

- If Spain adopts Peppol: Companies with Peppol connectivity have immediate advantage

- If Spain keeps using its own system: You may need to build Spanish-specific integrations

Our expectation: In the long term, Spain will likely converge toward Peppol or at least Peppol compatibility, driven by European harmonization. But in the short term (2026-2028), companies must count on Spanish-specific requirements.

From complexity to clarity: Start preparing now

The Spanish e-invoicing transition is complex – no doubt about it. The dual track of VeriFactu (software certification) and future B2B mandate (electronic exchange) creates confusion, especially for international companies.

But one thing is certain: doing nothing is not an option.

For Dutch companies WITH Spanish establishment:

The deadline of January 1, 2026 is approaching fast. In less than three months you must be VeriFactu-compliant. Start today with:

- Software evaluation

- Contact with suppliers

- Testing and training

For Dutch companies WITHOUT Spanish establishment:

Even if you may not fall under the obligations, it’s wise to:

- Keep following developments

- Have conversations with Spanish customers

- Consider voluntary e-invoicing as a strategic advantage

- Evaluate Peppol connectivity for future European compliance

For both groups:

Spain is not the last country mandating e-invoicing. With Belgium (January 2026), France (September 2026), Slovenia (January 2027), Greece (February 2026) and EU-wide ViDA requirements (2030), e-invoicing is becoming the new standard in Europe.

Investing in digital invoicing infrastructure now means:

- Compliance with multiple countries at once

- Lower transaction costs through automation

- Faster payments

- Better relationships with international customers

- Competitive advantage in a digitalizing market

The Spanish e-invoicing transition is complex, but with the right preparation and guidance it’s manageable. By taking action now, you transform a compliance obligation into a strategic advantage.

Do you have questions about e-invoicing in Spain or other European countries? Or would you like to know which Peppol service provider best suits your international trading situation? Visit Peppol.nu for more information and check our overview of Peppol suppliers. For specialist support with complex international e-invoicing strategies, you can contact Solventis.

Sources

- Global VAT Compliance – Spain: Mandatory e-invoicing starts 2026

- Maros VAT – Verifactu in Spain: Complete Guide

- EDICOM Global – VeriFactu System in Spain

- VATCalc – Spain VERI*FACTU 2026 certified e-invoicing

- VATCalc – Spain free e-invoicing ahead of 2026 VERI*FACTU

- Lextax – VeriFactu & E-Invoicing in Spain: Your 2026 Compliance Guide

- Comarch – E-Invoicing in Spain

- Space Invoices – Spain’s Mandatory B2B E-Invoicing

- Tradeshift – VeriFactu & E-Invoicing in Spain: Your 2026 Compliance Guide

- European Commission – eInvoicing in Spain

- BOE – Ley 18/2022, de creación y crecimiento de empresas

For current developments around e-invoicing in Spain and practical implementation advice, stay informed through specialized e-invoicing platforms and advisors. Regulations are still in development and may change.